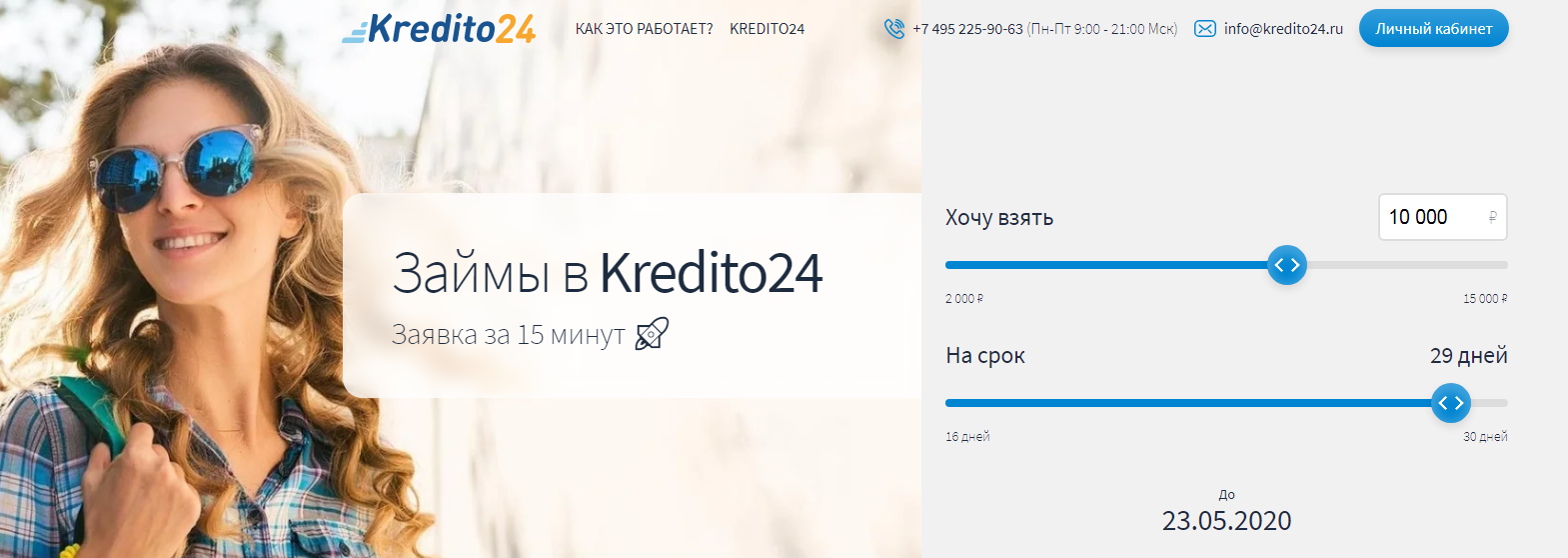

Discovering Kredito24

It all started when I found myself in a bit of a financial pinch. I had heard about various online loan services, but I wanted something reliable and straightforward. After some research, I stumbled upon Kredito24.ru. The website promised instant loans for small credit needs, which sounded perfect for my situation. According to a review on TechMistri, the Kredito24 loan app is designed to cater to small credit needs, offering amounts ranging from Rs 1000 to Rs 10,000 per month (TechMistri, 2024).

Researching My Options

Before making any decisions, I spent a few days reading reviews and comparing different platforms. I found that Kredito24 was consistently rated well across various sites. One article highlighted that Kredito24 is accessible on any device connected to the internet, making it convenient for users like me (MyCredy, 2024). I appreciated that I could apply for a loan from the comfort of my home, without the hassle of visiting a bank.

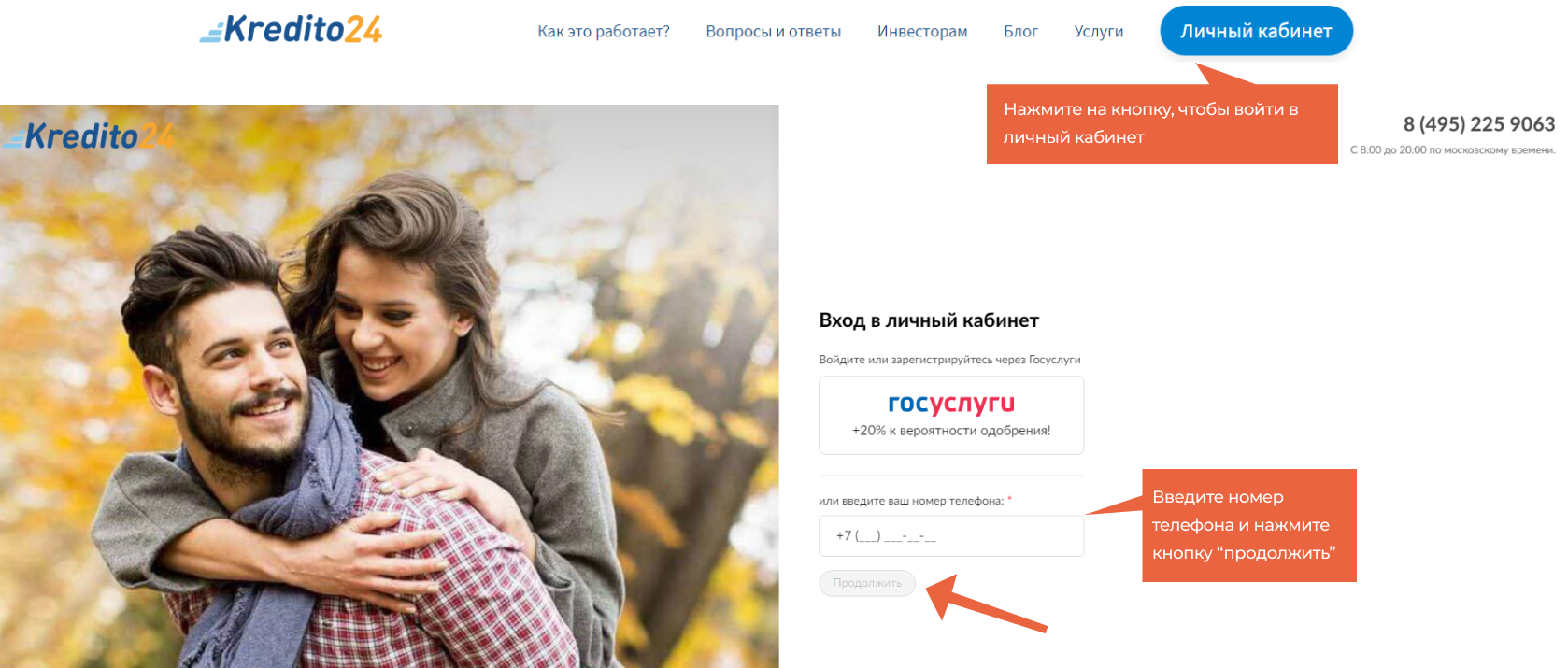

The Application Process

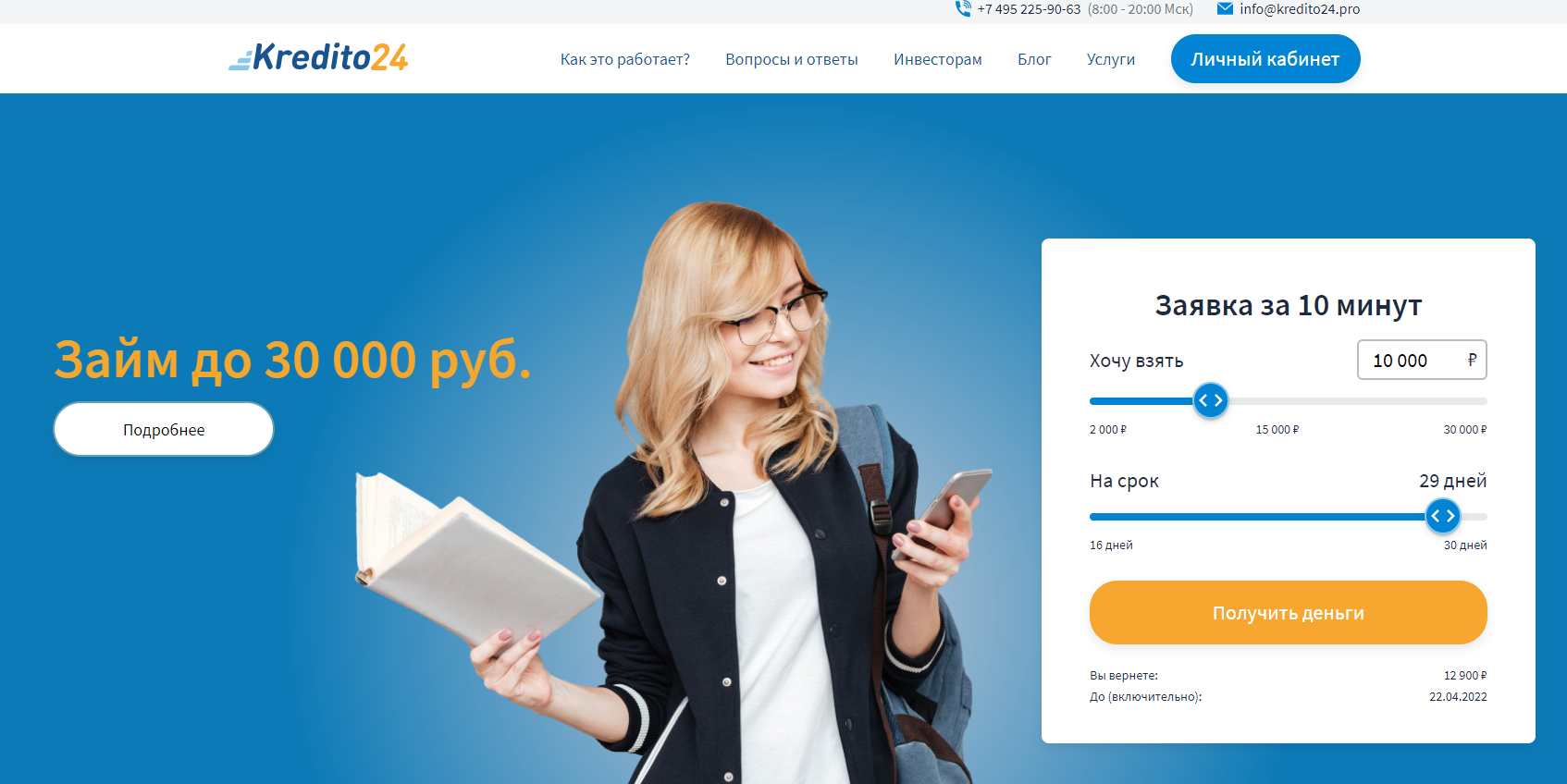

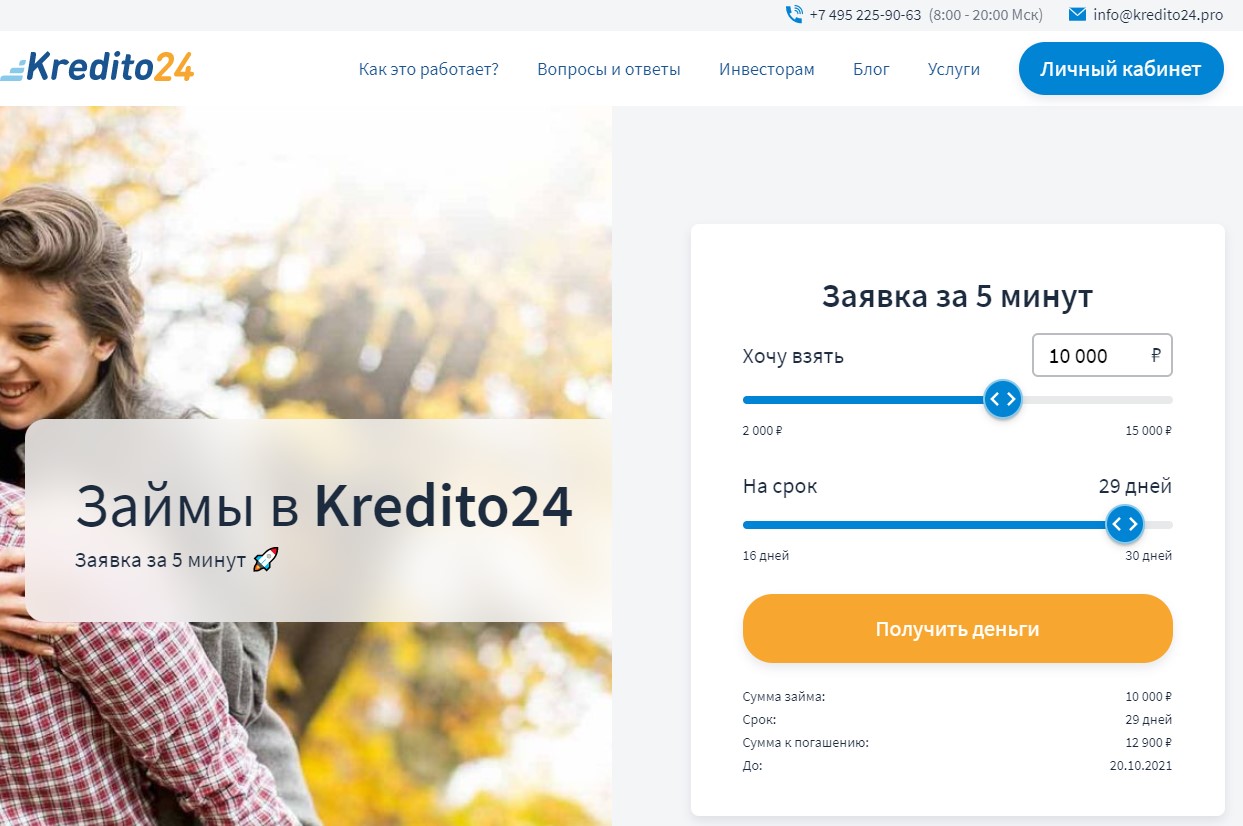

Once I decided to go ahead with Kredito24, the application process was surprisingly simple. I filled out the online registration form, which took just a few minutes. The platform allows you to apply for loans up to 40,000 INR, which was more than enough for my needs (Kredito24.in, 2024). I was a bit nervous about the approval process, but I was reassured by the fact that Kredito24 uses machine learning algorithms to assess creditworthiness, which I read about on Tracxn (Tracxn, 2024).

First Impressions

To my delight, I received an instant decision on my loan application. Within 10 minutes, the funds were transferred to my account! This was a huge relief, as I needed the money urgently. The entire experience felt seamless and efficient, which is something I truly valued during a stressful time.

Using the Loan

After receiving the loan, I used the funds to cover some unexpected medical expenses. It was a huge weight off my shoulders knowing that I could manage my finances without falling into a deeper hole. I also appreciated that Kredito24 offers flexible repayment options, which made it easier for me to plan my budget (APN News, 2024).

Unexpected Findings

One thing I didn’t expect was how user-friendly the app was. I had anticipated some technical glitches or a complicated interface, but everything was straightforward. I could easily track my loan status and repayment schedule right from my phone. This convenience made managing my finances much less stressful.

Practical Insights

For anyone considering using Kredito24, I have a few tips:

- Read the Terms Carefully: Make sure you understand the repayment terms and any fees involved.

- Plan Your Repayment: Set reminders for your repayment dates to avoid any late fees.

- Use the App Features: Take advantage of the app’s features to track your loan and manage your finances effectively.

Value Assessment

Overall, my experience with Kredito24 has been positive. The speed and efficiency of the service exceeded my expectations. While I did have some initial concerns about online lending, Kredito24 proved to be a reliable option. I felt secure knowing that I was dealing with a reputable company that has been in the market since 2013 (Kredito24, 2024).

Future Plans

Looking ahead, I plan to use Kredito24 again if I find myself in a similar situation. The ease of access and quick turnaround time make it a valuable resource for anyone needing a small loan. I also appreciate that they offer loans from reliable credit partners, which adds an extra layer of trust (Kredito24.in, 2024).

Conclusion

In conclusion, my journey with Kredito24.ru has been a positive one. From the initial research to the application process and ongoing use, I felt supported and informed every step of the way. If you’re in need of a quick loan and want a hassle-free experience, I highly recommend giving Kredito24 a try. It might just be the solution you’re looking for!

References:

- TechMistri. (2024). Kredito24 Loan App Review: Real or Fake? Retrieved from TechMistri

- MyCredy. (2024). Kredito24.in – Lender ratings and reviews. Retrieved from MyCredy

- APN News. (2024). Kredito24 – Your Trusted Financial Partner in India. Retrieved from APN News

- Tracxn. (2024). Kredito24 – Company Profile. Retrieved from Tracxn

- Kredito24. (2024). Official Website. Retrieved from Kredito24

References

[1] Kredito24 Loan App Review: Real or Fake? – TechMistri

[2] Apple Watch Series 10 In-Depth Review | DC Rainmaker

[3] Canon EOS R5 II in-depth review: Digital Photography Review

[4] Kredito24.in – Lender ratings and reviews – MyCredy भारत

[5] Kredito24 – Your Trusted Financial Partner in India – APN News

[6] Clinical incident investigations – in-depth case review – Health.vic

[7] Sony a9 III in-depth review – Digital Photography Review

[8] Reviews.org — In-Depth Reviews of Home Services & Products

[9] Kredito24 – Company Profile – Tracxn

[10] Kredito24: отзывы о микрофинансовой организации, контакты, реквизиты …

[11] Kredito24 loan app harassment | Consumer Complaints Court