My MonarchMoney.com Experience 2024: A Journey to Financial Clarity

When I first stumbled upon MonarchMoney.com, I was in the midst of a financial whirlwind. Like many, I was juggling multiple accounts, trying to keep track of my spending, savings, and investments. I had heard whispers about personal finance tools, but nothing seemed to resonate until I found Monarch. This is my journey from research to ongoing use, and I hope it connects with fellow shoppers looking for clarity in their financial lives.

Discovering MonarchMoney.com

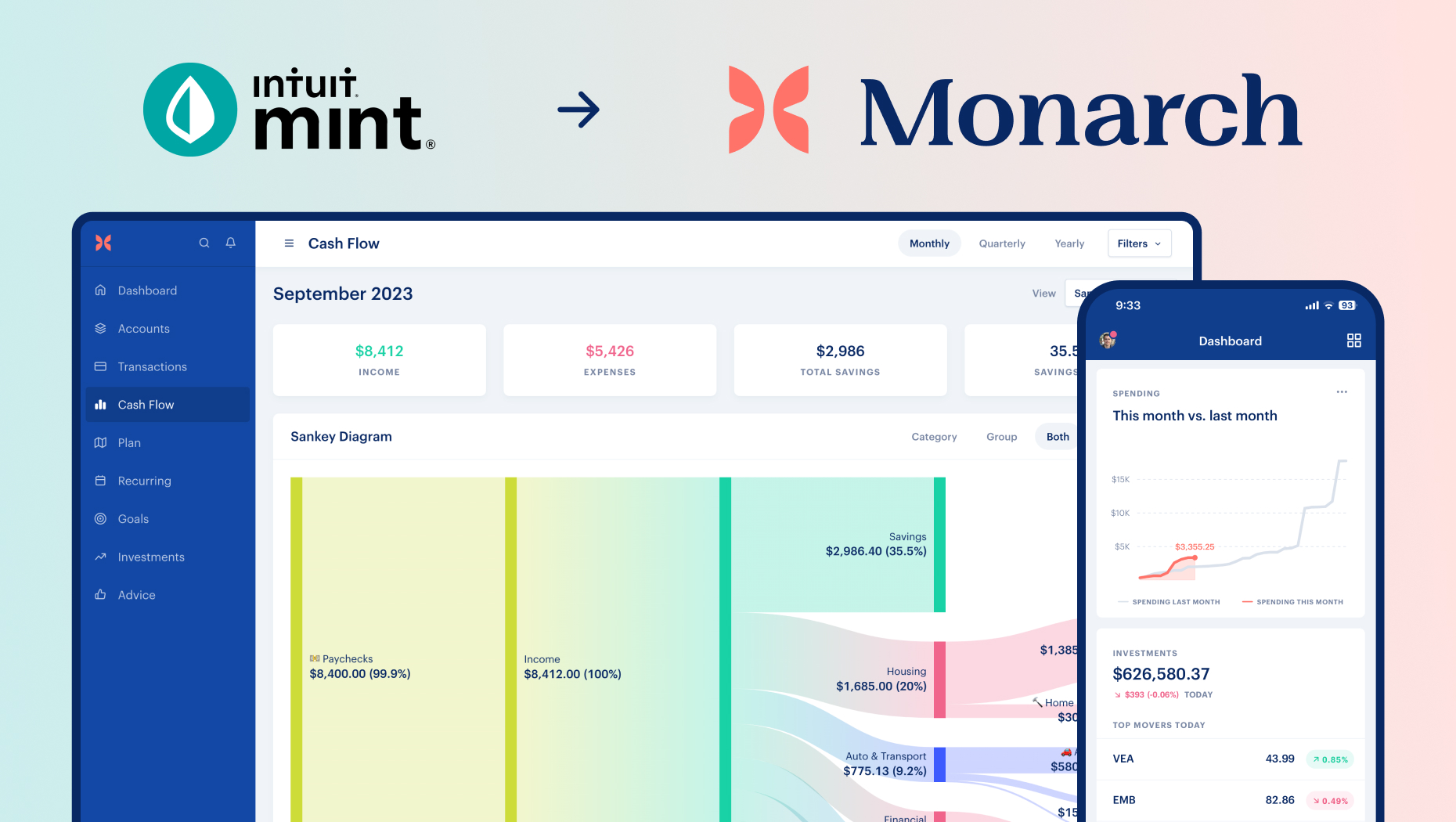

It all started one evening while scrolling through social media. A friend shared a post about MonarchMoney, highlighting its user-friendly interface and comprehensive financial tools. Intrigued, I clicked on the link and was immediately drawn in by the clean design and promise of simplifying my financial management. I knew I had to dig deeper.

Research and Decision Process

I spent the next few days researching MonarchMoney. I read through various articles and reviews, and what stood out to me was their commitment to connecting financial accounts seamlessly. According to their Guide to Connecting Your Accounts, Monarch uses three main data providers—Plaid, Finicity, and MX—to ensure the best connection for users. This gave me confidence that my financial data would be handled securely and efficiently.

The Purchase Experience

After feeling reassured by my research, I decided to sign up. The process was straightforward. I created an account, and within minutes, I was prompted to connect my financial accounts. The interface was intuitive, making it easy to navigate through the setup. I appreciated that Monarch defaults to the provider with the best connection, but also allows you to choose a different one if needed. This flexibility was a pleasant surprise!

First Impressions

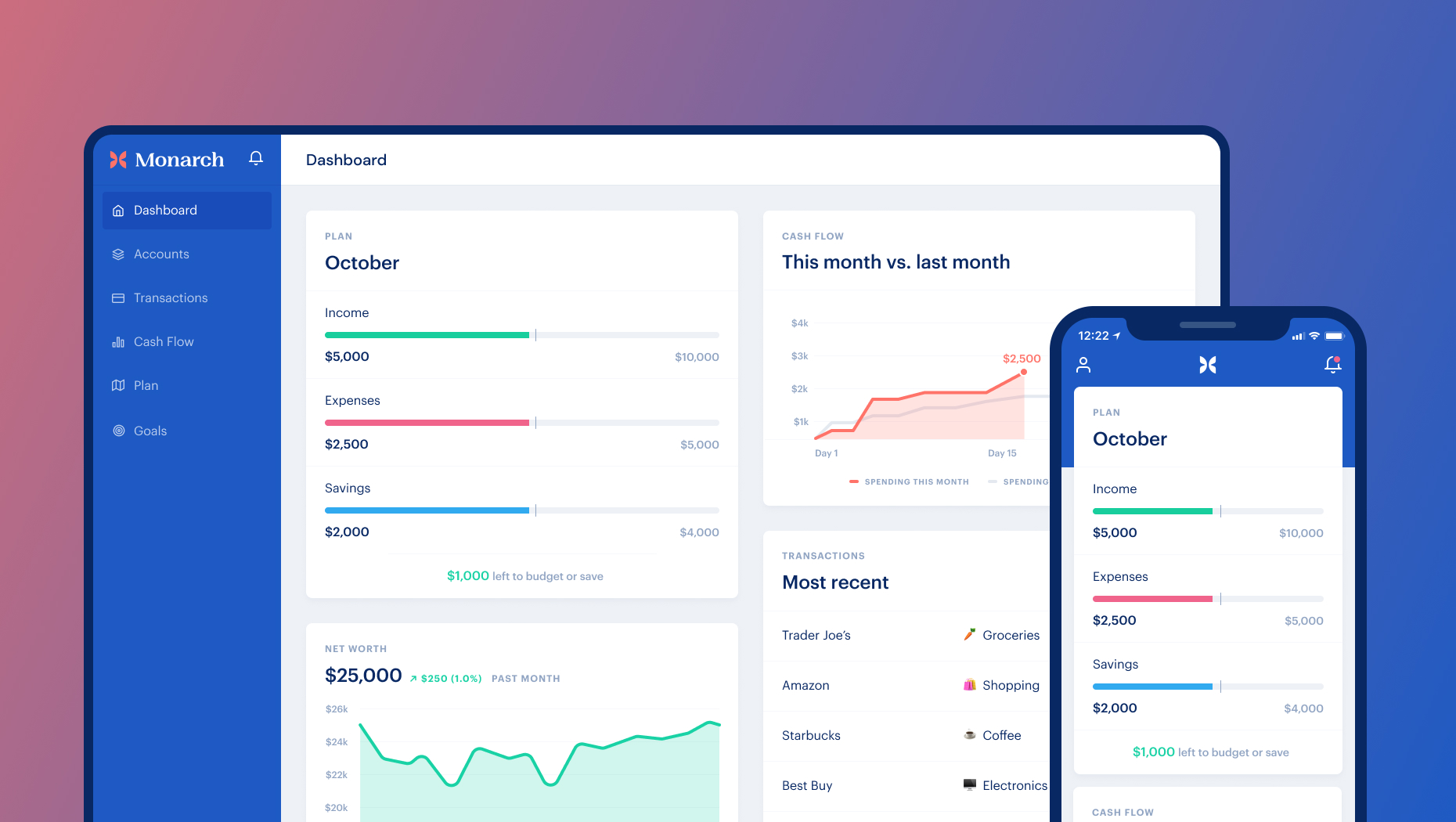

Once I was all set up, I took a moment to explore the dashboard. My first impression was that it felt like a breath of fresh air compared to other financial tools I had tried. The layout was clean, and I could see all my accounts in one place. It was a relief to finally have a comprehensive view of my finances without the clutter. I felt empowered to take control of my financial journey.

Usage Scenarios

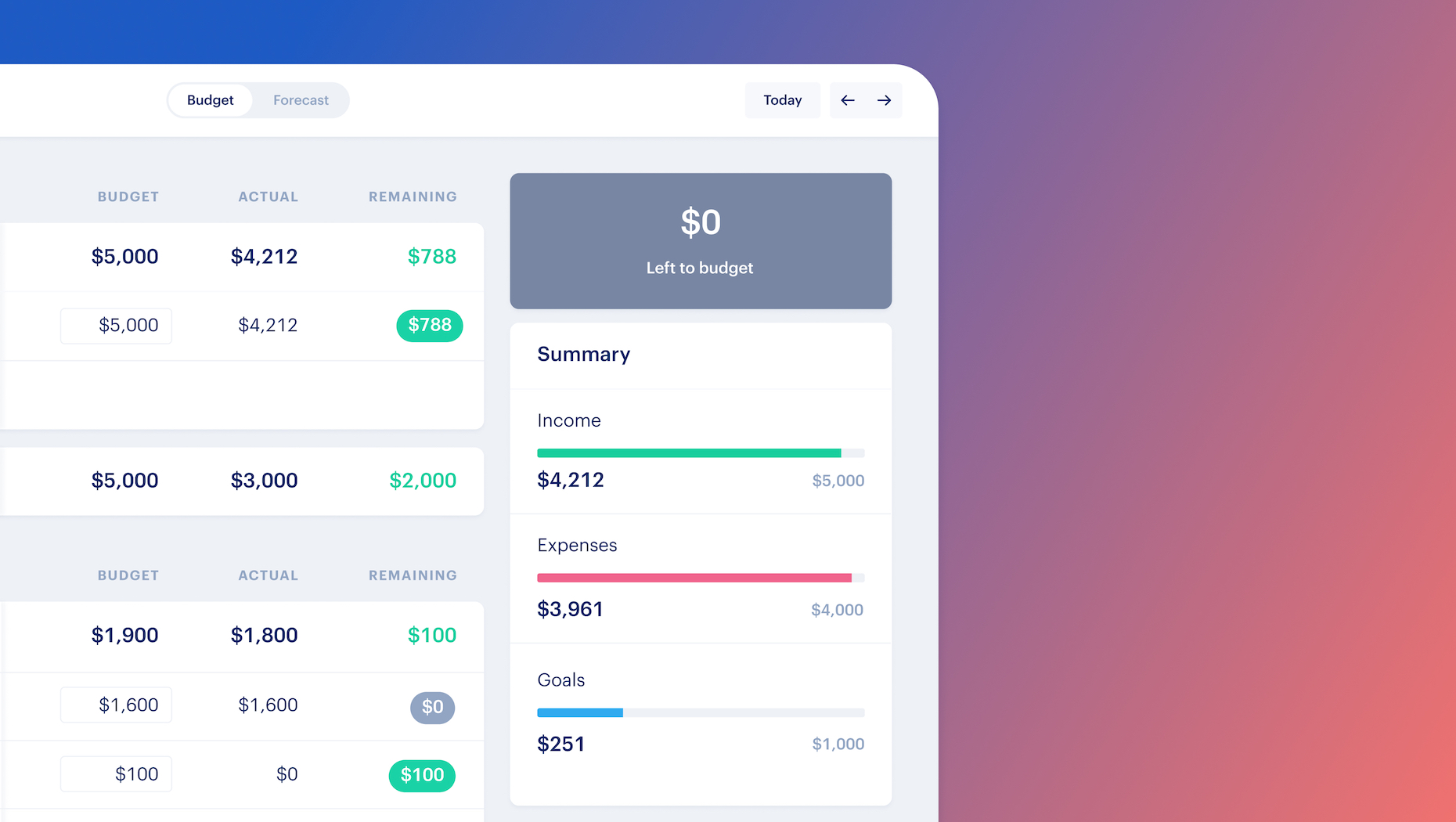

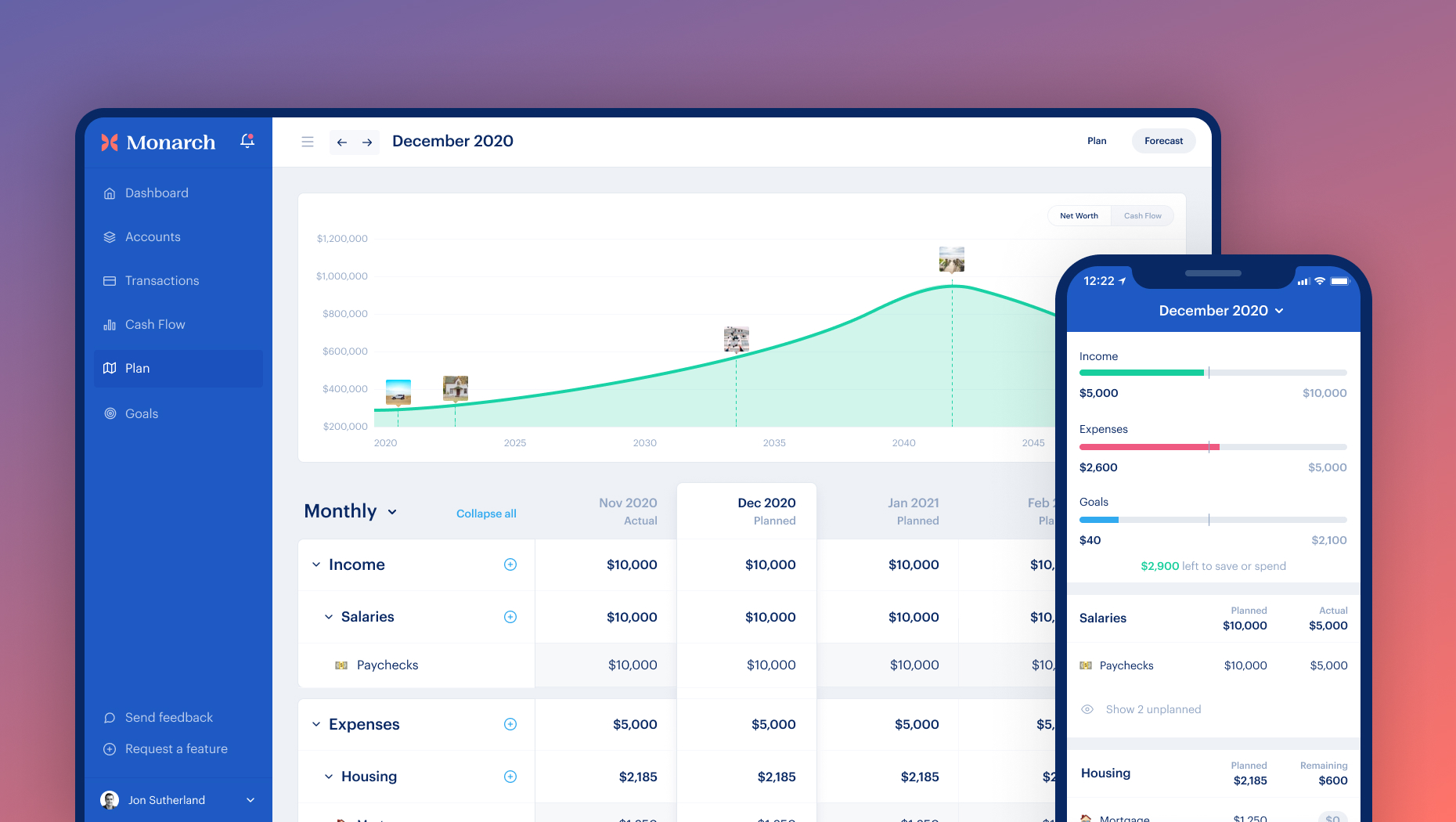

As I began using MonarchMoney, I discovered various features that truly enhanced my experience. The budgeting tools were particularly helpful. I could set spending limits for different categories and track my progress in real-time. This feature helped me become more mindful of my spending habits. I also loved the goal-setting aspect, which allowed me to plan for future expenses and savings.

Unexpected Findings

One unexpected finding was the community aspect of MonarchMoney. I had initially thought it was just a tool for managing finances, but I soon realized there was a wealth of resources available, including articles and tips from other users. This sense of community made me feel less alone in my financial journey. I found myself engaging with others, sharing tips, and learning from their experiences.

Practical Insights

Throughout my journey with MonarchMoney, I picked up several practical insights that I believe could help others:

- Start Small: If you’re new to budgeting, begin with one or two categories. This makes it less overwhelming.

- Regular Check-Ins: Make it a habit to review your finances weekly. This keeps you accountable and helps you adjust your budget as needed.

- Utilize Goals: Set specific financial goals, whether it’s saving for a vacation or paying off debt. This gives you something to work towards and keeps you motivated.

Value Assessment

Reflecting on my experience, I can confidently say that MonarchMoney has added significant value to my financial life. The ability to see all my accounts in one place has not only simplified my budgeting process but has also given me peace of mind. I no longer feel overwhelmed by my finances; instead, I feel empowered and informed.

Future Plans with MonarchMoney

Looking ahead, I plan to continue using MonarchMoney as my primary financial management tool. I’m excited to explore more of its features, such as investment tracking and retirement planning. I believe that as my financial situation evolves, Monarch will be there to support me every step of the way.

Conclusion

In conclusion, my journey with MonarchMoney.com has been nothing short of transformative. From the initial discovery to ongoing use, I have found a tool that not only meets my needs but also connects me with a community of like-minded individuals. If you’re on the fence about trying MonarchMoney, I wholeheartedly recommend giving it a shot. It might just be the financial clarity you’ve been searching for!

I hope my experience resonates with you and helps you in your own financial journey. Remember, taking control of your finances is a step towards a brighter future!

References

[1] Guide to Connecting Your Accounts – Help | Monarch …

[2] Download on web, iphone, ipad, and android

![Click to view product Monarch Money Review [2024]: Track, Save, and Budget All In One Place | FinanceBuzz](https://images.financebuzz.com/0x0/filters:quality(75)/images/2022/05/04/logo-full-black_1.png)